How Specific Financial Goals Transform Your Service Business

If you’ve ever set a goal like, “I want to hit $50K months” or “I’d love to make $500K this year,” you already know how frustrating those kinds of targets can feel.

They sound impressive. They look great on your vision board. But when it comes to actually running your business, vague financial goals like these often do more harm than good.

Why? Because they don’t connect to your real numbers. They don’t tell you how much you can safely pay yourself. They don’t help you decide what to cut, what to keep, or how to allocate your business revenue.

The truth is, most self-employed service providers don’t need “big, shiny goals.” They need specific financial goals that connect to their actual needs and their actual numbers.

The Power of Specificity

Let’s look at the difference between vague goals and specific goals:

Vague goal: “I want to have $50K months.”

Specific goal: “I need to bring home $5,600 a month to cover housing, food, and personal bills.”

Which one gives you more focus?

Which one makes it easier to decide if you should accept a new client or raise your prices?

Specific goals provide clarity, control, and confidence. Vague goals create overwhelm and frustration.

Why Vague Goals Keep You Stuck

Here’s what happens when you set random, arbitrary financial goals:

You feel overwhelmed. Big numbers sound exciting, but when you don’t know how to reach them, they just feel impossible.

You don’t know what to do next. A $50K month doesn’t tell you how many clients you need, how much to charge, or how to manage your expenses.

You burn out faster. Chasing revenue without context leads to overspending, underpricing, and paying yourself last.

In short: vague goals aren’t actionable.

Why Specific Goals Change Everything

When you set financial goals that are tied to your actual numbers, you instantly become a better decision-maker.

Here’s how specific goals transform your business:

1. They Give You a Clear Baseline

Knowing that you need to bring home $5,600 a month to cover your personal bills helps you set your minimum income target. From there, you can reverse-engineer your prices and sales goals.

2. They Improve Spending Decisions

When you know exactly how much you need to cover essentials, it’s easier to decide whether that new software subscription is worth it — or if you should cut back.

3. They Help You Pay Yourself Consistently

Instead of guessing what’s safe to transfer, specific goals show you exactly how much your business needs to make to support both your expenses and your paycheck.

4. They Reduce Stress

You don’t have to wonder if you’ll have enough at the end of the month. You already know what “enough” looks like, and you’ve built your business around that number.

Tools That Make Goal Setting Easier

Specific financial goals require specific data. Here are the tools we recommend to our clients:

QuickBooks Online (QBO)

Keeps your business books organized and accurate.

Shows your real revenue, expenses, and net profit every month.

Helps you see exactly what your business can afford.

Monarch Money* (personal finance tool I love)

Puts all your personal finances in one place — cash, credit cards, and investments.

Helps you understand your personal expenses so you know what you need to bring home from the business.

* This is an affiliate link

When you combine business numbers from QuickBooks with personal clarity from Monarch Money, you get the full financial picture.

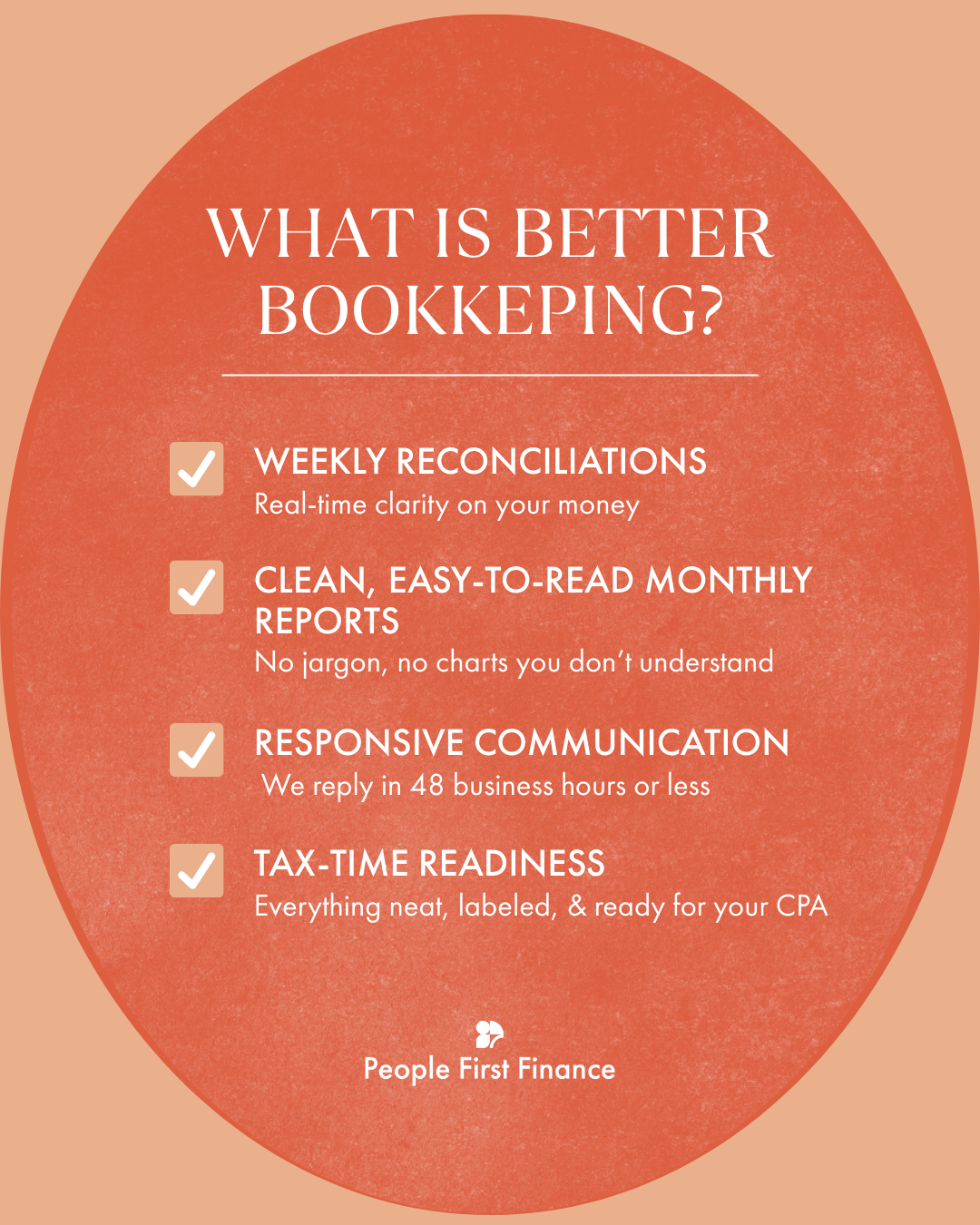

How Better Bookkeeping Helps You Hit Your Goals

Here’s the truth: vague goals often happen because your numbers are messy. If your books aren’t accurate, you can’t set specific targets — you’re just guessing.

That’s why Better Bookkeeping is designed to give service providers clarity every month:

Weekly transaction reviews keep your books current.

Monthly reconciliations ensure your QuickBooks balance matches your bank balance.

Profit & Loss statements show you exactly how much your business makes and spends.

Tax savings estimates help you plan ahead instead of panicking.

With accurate, tax-ready numbers, you can set specific financial goals — and actually reach them.

The Bottom Line

If your financial goals feel random or overwhelming, it’s not that you’re “bad with money.” It’s that your goals aren’t connected to your actual numbers.

The fix? Specificity.

When you know how much you need to bring home, how much to save for taxes, and how much to leave in reserves, you can:

Pay yourself consistently

Make smarter spending choices

Stop stressing about money every single month

📅 Ready to set specific goals that transform your business? Book a call with People First Finance today and let us help you turn vague dreams into clear, actionable numbers.