Why Mental Math Is Keeping Business Owners Broke (and How to Fix It)

You glance at your bank account. Looks good.

You subtract a couple of expenses in your head. Should be ok, right?

You guess how much you can pay yourself — or whether you can afford that new hire.

That “quick check” might feel harmless, but it’s the reason so many service-based business owners feel broke, even when their revenue is strong.

Mental math is one of the fastest ways to stay stuck in financial stress, surprise tax bills, and inconsistent paychecks.

What Does “Mental Math” Look Like as a Business Owner?

Mental math is when you:

Decide how much to pay yourself based on what’s in your bank account today.

Estimate expenses without actually tracking them.

Assume you’re making a profit because you have client payments coming in.

Base big decisions on guesses instead of real numbers.

It’s not that you’re bad at math — it’s that you’re missing the whole picture.

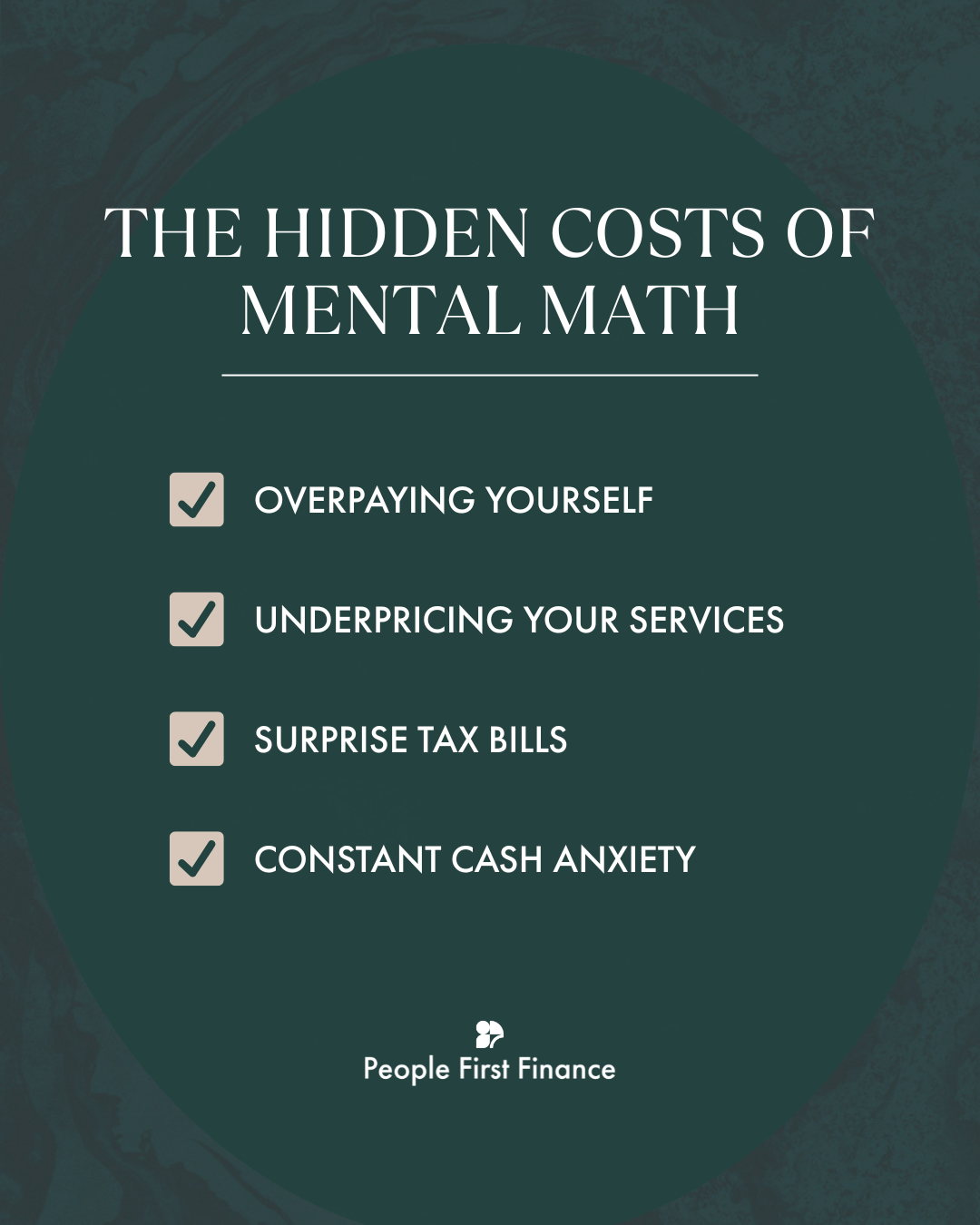

The Hidden Costs of Mental Math

Overpaying Yourself

You take out more than the business can actually afford. The result? Cash flow problems, unpaid bills, or tax savings that vanish.

Underpricing Your Services

Without knowing your true costs, you set rates based on what “feels” right — often leaving money on the table. This makes it challenging to scale your service or grow your business because you don’t have healthy margins.

Surprise Tax Bills

Mental math doesn’t factor in your actual net profit and tax rate, so April (or quarterly deadlines) hits hard.

Constant Cash Anxiety

You’re always wondering, “Do I actually have enough?” — but never really sure.

Why Mental Math Feels Easier (But Hurts More)

It’s quick: No logging into software, no spreadsheets.

It feels familiar: Many of us manage personal money this way — and bring the habit into business.

It avoids discomfort: Looking at real reports can be intimidating if you’re not confident with numbers.

But here’s the truth: Mental math only gives you part of the story. And those missing pieces are usually where the problems — and profits — hide.

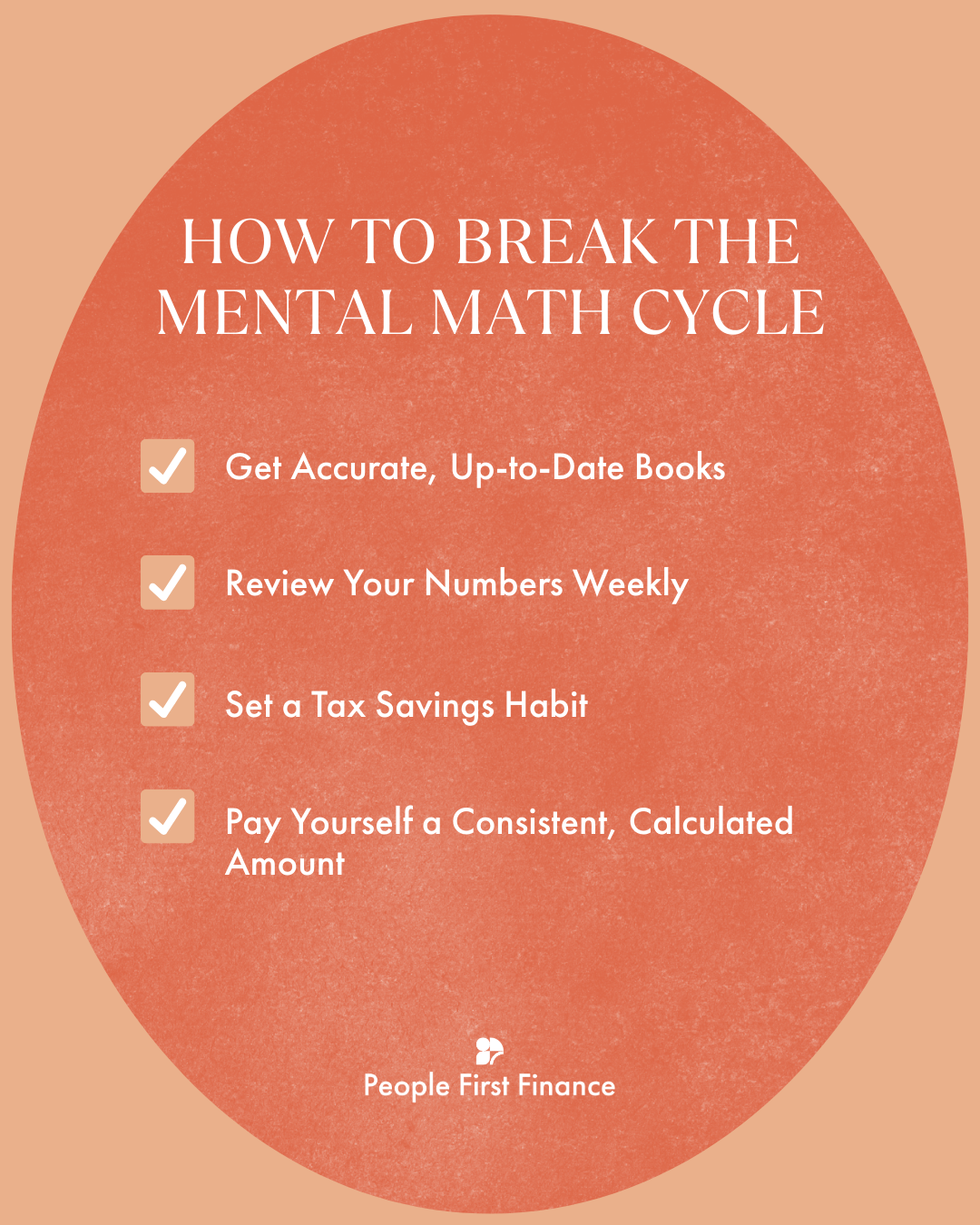

How to Break the Mental Math Cycle

Step 1: Get Accurate, Up-to-Date Books

Every dollar in and out of your business should be tracked and categorized.

This isn’t busywork — it’s the foundation for every smart decision you make.

Step 2: Review Your Numbers Weekly

Look at actual reports, not just your bank balance.

Your Profit & Loss statement tells you your real revenue, expenses, and profit.

Step 3: Set a Tax Savings Habit

Use your monthly profit to calculate a set percentage for taxes — and move it to a separate account.

Step 4: Pay Yourself a Consistent, Calculated Amount

Decide on an owner's pay percentage based on profit, not just “what’s left.” Better yet, only pay yourself 1x a month vs., as money comes in. This ensures that your paycheck is a reward for a profitable business!

Why put in the work to break the mental math cycle?

Once you understand your numbers and adjust your prices accordingly, you’ll likely be able to make MORE money, doing the same amount of work. Who wouldn’t want that?!

Why Better Bookkeeping Is the Cure for Mental Math

When you’re not a numbers person, switching from mental math to real data can feel overwhelming.

That’s why we built Better Bookkeeping for service providers who:

Want to stop guessing about their financial health.

Need accurate, tax-ready books every month.

Want clear, plain-language insights about what to do next.

With Better Bookkeeping, you get:

Weekly transaction reviews so your books are always current.

Monthly Profit & Loss statements you can actually understand.

A tax savings estimate every month — no more guesswork.

The confidence to make pricing, hiring, and expense decisions without fear.

Ready to Get Serious About Your Business?

When you stop guessing and start using accurate, up-to-date numbers, you’ll know exactly:

How much to pay yourself.

When you can invest in growth.

How to protect your cash from surprise tax bills.

Book an intro call today and let us get your business out of mental math mode — for good.